The Bank of England could be forced into abandoning the interest rate cutting cycle as soon as the second half of 2025 as inflation risks grow.

The Bank of England is widely expected to announce a 25-basis-point rate cut on February 6 and mark a shift toward more aggressive easing to counteract a stagnating UK economy.

However, growing inflation concerns could force the central bank to halt rate cuts sooner than expected, according to Andrew Wishart, Senior UK Economist at Berenberg Bank.

“The BoE is likely to hint at further cuts in March, as declining employment signals the need for urgent action,” Wishart wrote in a recent research note. “However, inflation risks remain underappreciated, and the easing cycle may need to be paused later in the year.”

Such a development would blindside markets that see at least three interest rate cuts in 2025 spread over the duration of the year. The consensus amongst economists is that the total would run to four.

Berenberg’s call, therefore, means a ‘hawkish’ reappraisal looms.

The Bank’s Monetary Policy Committee (MPC) remains divided on the best course of action. While the dovish faction argues that weaker employment will dampen demand and inflation, hawkish policymakers are not convinced.

“Catherine Mann is likely to dissent, voting to hold the policy rate at 4.75%, given the inflationary risks,” Wishart noted. “Rate cuts would be uncontroversial if this downturn were purely demand-driven—but it’s not.”

Instead, Wishart points to structural labour cost pressures as a major inflation driver. A minimum wage hike and payroll tax increases set for April 01 could push up business costs, leading to wage-price pressures that monetary policy cannot easily counteract.

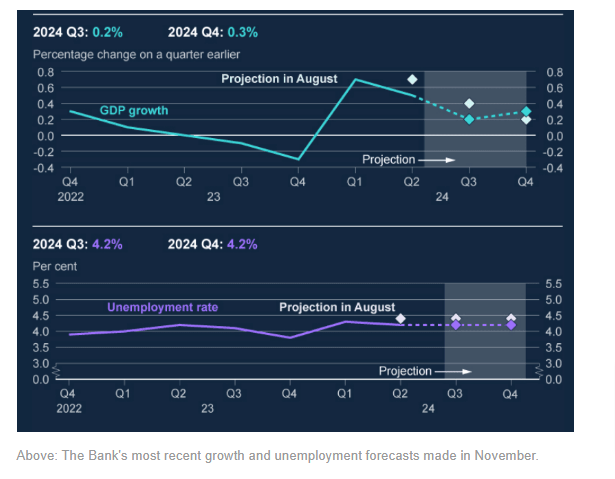

The Bank’s latest economic projections are expected to reflect weaker growth and lower inflation over the coming years. GDP growth, previously forecast at 1.5% in 2025, will likely be revised down to 1.0%, as Q3 and Q4 of 2024 saw zero growth.

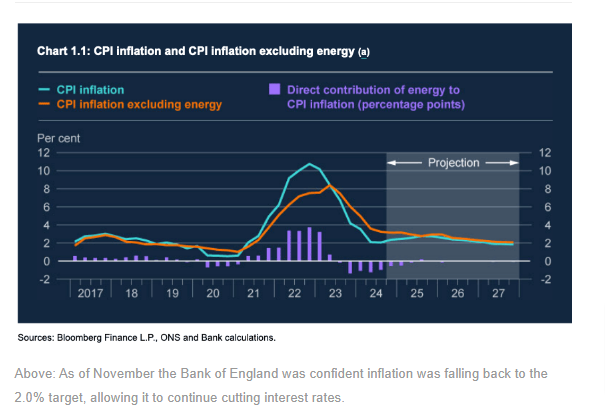

“Inflation is expected to slow in the long run, with the CPI forecast for Q1 2027 dropping to 1.7% from 2.1%,” Wishart wrote. “A forecast below 2% inflation in two years’ time suggests the need for looser policy in the short term.”

Inflation Pressures Reignite

The Bank’s November 2024 Monetary Policy Report showed it expected inflation to peak at around 2.75% by the second half of 2025 before falling to 2.2% by the end of 2026 and 1.8% by the end of 2027.

Despite these disinflationary expectations, evidence already suggests near-term inflation risks are rising, prompting concerns that rate cuts may fuel renewed price pressures as the economic textbook says cutting interest rates is reflationary while raising them is deflationary.

The Bank’s Decision Maker Panel survey indicates that firms expect price growth of 4% in 2025, reversing previous expectations of slowing inflation.

“The survey data are flagging a renewed increase in inflation,” Wishart warned. “We now expect inflation to rise to 3.0% this year, above the consensus forecast of 2.6%.”

Wishart suggests that while faster rate cuts could provide short-term relief, inflation risks will likely force the BoE to stop easing by the second half of 2025.

“There is a risk that the BoE reduces interest rates faster than we expect in the near term,” he cautioned. “However, rising government spending and price pressures could force policymakers to hit the brakes on monetary easing later this year.”

Source: poundsterlinglive.com/